In the first year when you top-up your income with untaxed earnings from Airbnb and other types of side businesses you might need to save as much as 30 or 40 per cent of your new earnings for tax. The potential implementation of tourism tax on Airbnb properties in Malaysia is expected to follow the existing mechanism applied to hotels.

Pdf The Implementation Of Big Data Analysis In Regulating Online Short Term Rental Business A Case Of Airbnb In Beijing

This voucher can be used on domestic flights and rail booking as well as hotel accommodations.

. If youre in a 20 income tax bracket you will have to pay a total of 7060 in tax. KUALA LUMPUR July 2 Airbnb said today it welcomes Putrajayas proposal to tax its services along with other online firms but pressed for a fair structure amid growing scrutiny over the Singapore-based firms revenue. Airbnb is classified as a payment settlement entity and can report your income to the IRS depending on your account status and the taxpayer information youve submitted in case you earn more than 20000 and have more than 200 reservations in a year and send you a 1099-K tax form.

Citing Teo the Malay Mail reported today that tourism tax imposed on the local four- and five-star hotels does not affect the US online. Airbnb has broadly welcomed the Malaysian Governments decision to expand the tourism tax to include the short-term accommodation industry. Create a Danish unique code.

The provision of services as a host in Malaysia may be subject to service tax. The amount depends on the total income you earn and the amount of tax deducted from your other income sources. The Value-Added Tax or VAT in the European Union China and many other countries is a general broadly based consumption tax assessed on the value added to goods and services.

You can find the full info regarding this voucher here. Has agreed to work with Malaysia on tax collection with initial efforts to focus on a tourism levy as the government prepares to cast a wider net on the digital economy. Schedule C Example.

Yes of course we should have tax across the board Mike Orgill its South-east Asia Hong Kong and Taiwan. Lets say you make 20000 net profit from your Airbnb in 2021. Extend the moratorium on loan repayments.

The higher rate is 40 and applies to income of 50001 to 150000. As many affected Airbnb hosts rely on booking income to. While the tourism.

How To Redeem RM100 Digital Voucher For Local Travel. You will need to pay these taxes when you bring in more than 400 each year. You will be responsible to register yourself for service tax if the host income you earn as a host reaches RM 500000 or more per year.

There is potential criminal liability such as financial penalties andor imprisonment for carrying on business under a business name without being registered in respect of that name. It applies more or less to all goods and services that are bought and sold for use or consumption. Our place is half way between KK city Kundasang.

Income Tax Reporting by Airbnb. As such locals renting Airbnbs will. 20 income tax 153 self-employment tax 353 total tax rate times 20K.

Lastly the additional rate is 45 and applies to income of 150000 and above. Step out onto balcony and you will see a beautiful lake view. Malaysian who travels domestically in 2020 will be eligible to receive RM100 worth of digital voucher per person.

For 2020 self-employment has an Airbnb tax rate of 153 for the first 9235 of your income from self-employment. This homestay is equipped with private swimming pool and green neighbourhood. 12 July 2019.

He said the platform is exempt from the tourism tax imposed on the domestic hotel industry because Airbnb. In the 2021 Budget the Malaysian Government announced it would expand the tourism tax to include accommodation booked through online travel platforms such as Airbnb from 1 July 2021. Thats a lot of tax for a rental so you want to avoid a Schedule C if possible.

You are also required to collect tourism tax of RM 10 per room per night from foreigners staying in your properties. Malaysia is not benefitting from the taxes on short stay platforms like Airbnb because it is flowing out of the country said the the Malaysian Association of Hotel Owners MAHO president Tan Sri Teo Chiang Hong. Airbnb is obligated to deduct 1 of the gross earnings of Hosts who are residents of India and remit these funds to the Indian tax authorit.

Anjung Serene Private Pool 10 pax Semenyih. One-off payment of RM600 and personal income tax relief of RM1000 on expenditure related to domestic tourism until December 2021. The tourism tax which came into effect in September last year charges a flat rate of RM10 per room per night for foreigners who stay at hotels of all classes.

You will be required to register your business with the Companies Commission of Malaysia CCM before carrying on business in Malaysia. The San Francisco-based home-sharing company is moving to finalize a deal with tax authorities which will apply a new tourism tax of 10 ringgit 2. In England the basic tax rate is 20 and applies to income of 12501 to 50000.

Besides the outflow of money from the country this also means the burden of paying the tax falls upon the established hotel chains Teo was quoted. Anjung Serene is located at Serene Heights Semenyih. In Japan there is a similar tax called the Japanese Consumption Tax.

Money from tourists staying in Malaysia is leaving the country through alternative online booking sites like Airbnb the Malaysian Association of Hotel Owners MAHO president Tan Sri Teo Chiang Hong said last night. Digital vouchers of up to RM100 to all Malaysians for domestic tourism purposes to be enabled for Airbnb bookings. For the tax years 2021 and onwards hosts in Denmark will be required to create a unique code with the Danish tax authorities Skatdk in o.

Citing Teo the Malay Mail reported that tourism tax imposed on the local four- and five-star hotels do not affect the US online hospitality broker because the Airbnbs South-east Asian regional office is in Singapore.

Home Sharing Requires Regulation

Airbnb In Malaysia From A Property Investors Point Of View Rent Returns

Airbnb In Malaysia From A Property Investors Point Of View Rent Returns

Airbnb Free Night For New Accounts Minimum Two Nights Loyaltylobby

Airbnb In Malaysia From A Property Investors Point Of View Rent Returns

Airbnb Stay Tracker And Management Expense Cleaning Fee Etsy

Airbnb Joins Luxury Bandwagon Ttr Weekly

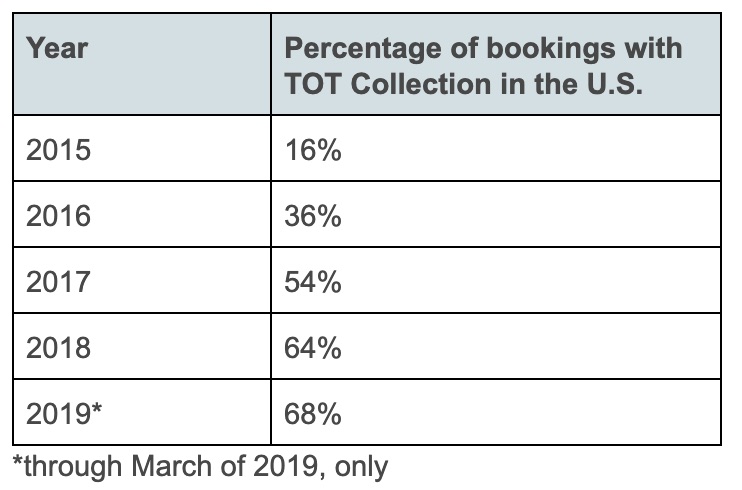

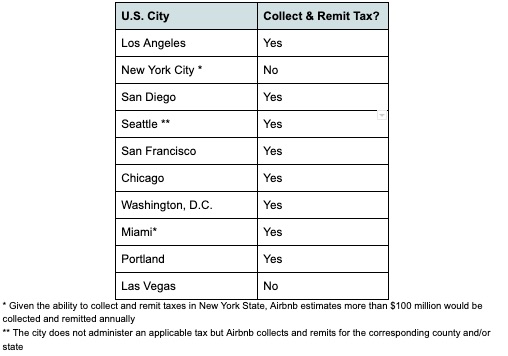

Airbnb Delivered Over 1 Billion In Taxes To Communities Across The Us Canada In 2021

Airbnb Collects Over 1 Billion In Tourism Taxes In The United States

Is Airbnb A Better Deal Than Just Renting Out Your Property Traditionally Imoney

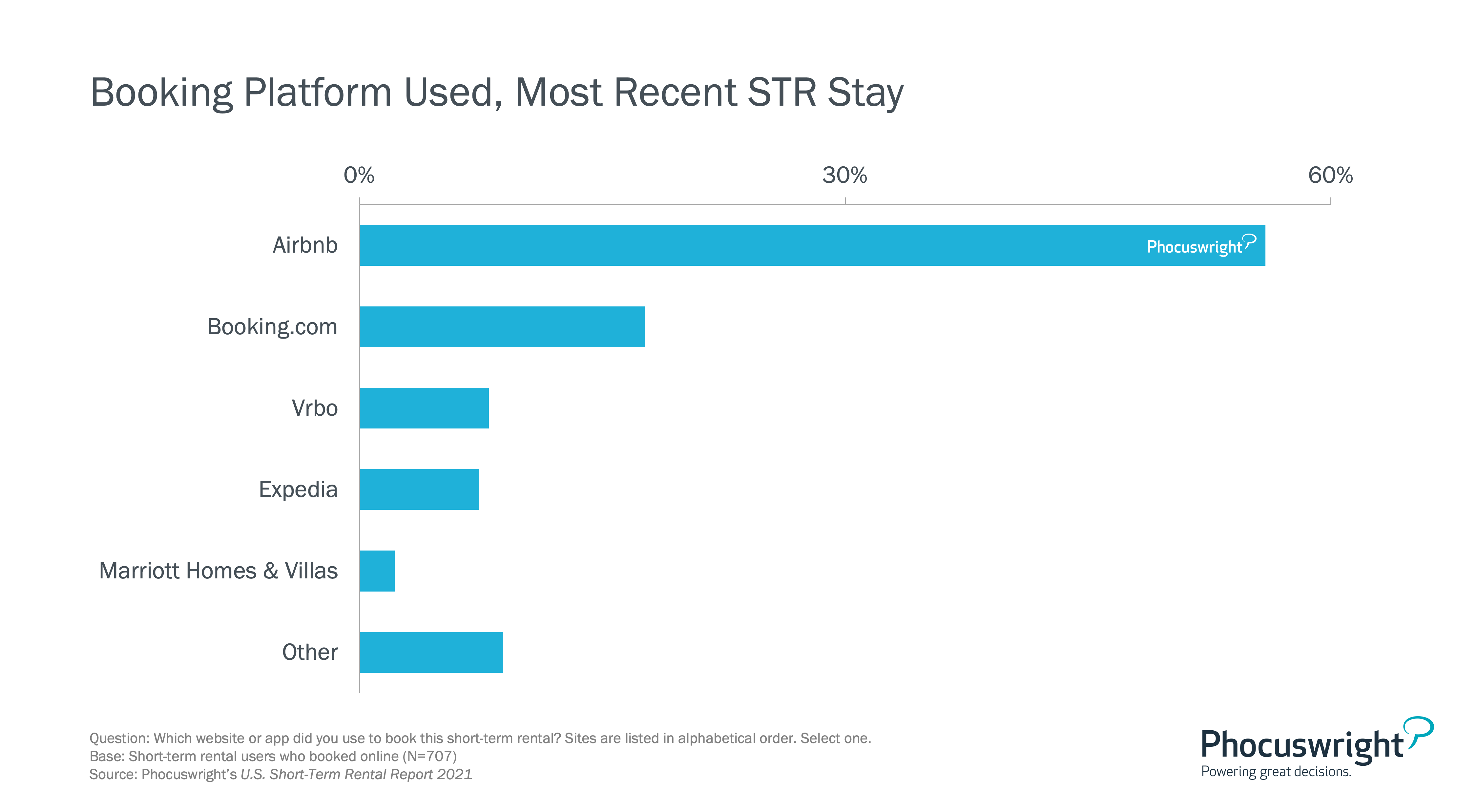

The Most Used Booking Platforms For Short Term Rentals And What Makes Them Attractive Phocuswright

Tax Exemption For Rental Income 2018 Donovan Ho

New Survey Eu Hosts Use Airbnb Income To Afford Rising Living Costs

Is Airbnb A Better Deal Than Just Renting Out Your Property Traditionally Imoney

Airbnb In Malaysia From A Property Investors Point Of View Rent Returns

Airbnb Collects Over 1 Billion In Tourism Taxes In The United States

Airbnb In Malaysia From A Property Investors Point Of View Rent Returns